How To Evaluate Potential Investments in New Party Rental Equipment

Evaluating potential investments in new party rental equipment should be more than a gut feeling or a friend saying “I think people would love that.” Capital budgeting is hard. With a limited budget, it is imperative that you select the investments with the greatest future return. The equipment you invest in today will determine the long-run financial health of your party rental business. I’ll break down 3 methods to evaluate potential party rental equipment investments, and go over in detail the one I think is the best.

1. The Payback Period Method for Party Rental Equipment Purchases

This is the easiest method to compute for party rental equipment investments. Just divide the investment required by the annual net cash inflow from the investment. However, with simplicity comes major limitations. The biggest problem with this method is that a shorter payback period doesn’t necessarily mean that it’s a better investment than one with a longer payback period. This method doesn’t consider the time value of money nor does it take into account how long the equipment lasts. For example, you could pay back linens with 1 rental, but linens don’t last that long. On the other hand, it may take you 10 rentals to pay for a tent, but it will last for several years.

2. Accounting Rate of Return Method / Simple Rate of Return

For the simple rate of return, divide the initial investment by the annual incremental net operating income. This one is different than the payback period because instead of looking at cash flow, we are looking at the net income generated by the investment. Again, I’ll call out linens because there are high maintenance fees (laundering and pressing) that need to be considered. So, this method is a little better because it makes you look at cash flow as well as expenses, but it still has limitations as it doesn’t consider the time value of money nor the useful life of the equipment.

3. Net Present Value Method (NPV)

The NPV Method is my favorite because it compares the value of the investment to the present value of the investment’s inflows and outflows. The drawback is that it is complicated to compute. Historically, you needed a present value table and a complicated formula: Cash flows divided by ( 1+discount rate) x the time period.

Now you can calculate it pretty easily using Excel or Google Sheets. I’ve created a Google Sheet for you here. Just click File – Make a Copy to create a version you can edit.

First you need to figure out the discount rate – this an acceptable rate of return for your company (or a rate you could get on other investments). Think of it as the rate to which you want to compare the potential investment. If you’ve learned from experience that anything lower than 30% isn’t worth the investment, then 30% is your discount rate.

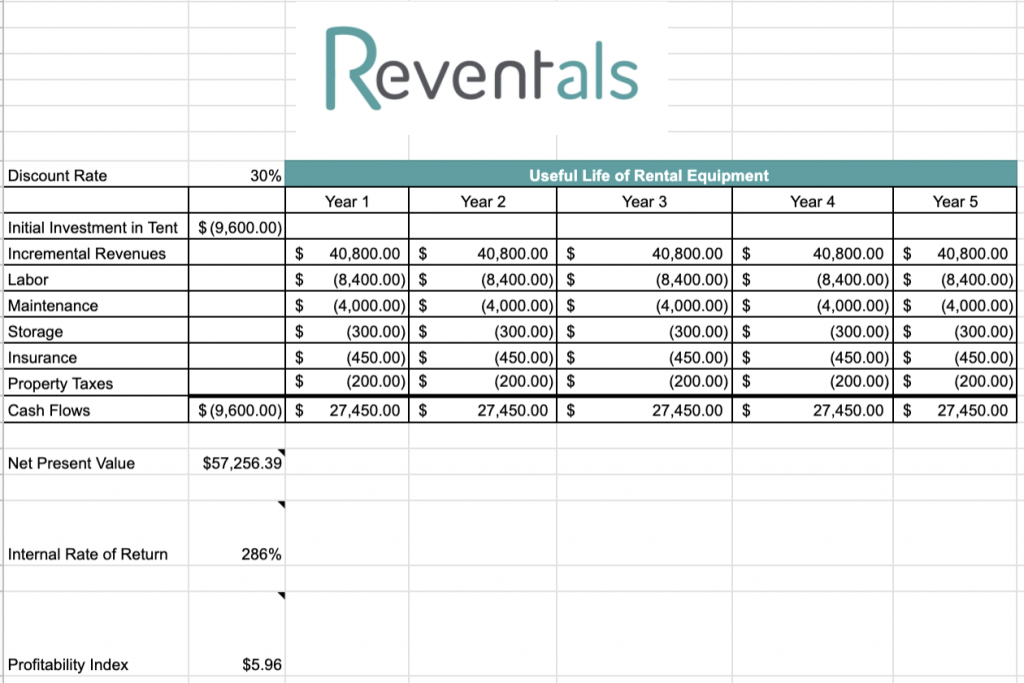

Next, figure our your net cash flows for the useful life of the investment. Here’s an example:

In this example, the Net Present Value of the $9600 investment in the tent is $57,256.39. This is a financially good investment. I say “financially” because there are other things to consider. The cons of offering tents are that it is a lot more work to delivery, setup and maintain; you need trained staff; and there is more liability involved. The major pro is that it opens your business up to much bigger events. Most of the time, people prefer to rent everything from one rental company. If they need a tent, and you don’t offer tents, they won’t consider you as a vendor for the event.

I set up the spreadsheet so the NPV will be calculated for you. The general rule is if the Net Present Value is greater than $0 then it is a good financial investment. If NPV < 0, it is a bad investment (the return is less than what you could make investing at the discount rate). And if NPV = 0, it is equal to your discount rate.

Two Other Tools for Evaluating Investments:

Internal Rate of Return Method (IRR)

Think of the IRR as the rate at which the investment breaks even. Technically IRR is the rate that makes the Net Present Value 0. What that means is that IRR compares the discount rate required by your company to the cash flows created by the investment. For example if you determine that an acceptable rate of return is 30%, and the IRR is higher than 30% then it is a good investment. You can use this Google Sheet to calculate the Internal Rate of Return. The rule of thumb is that if the internal rate of return is greater than 1, it is a good investment ( you are earning more than required by your discount rate). If IRR < 1, it is a bad investment, and if IRR = 1 then the net present value of the investment is $0.

Project Profitability Index (PPI)

The PPI is great for comparing investment options. First calculate the net present value of the different options. Then calculate the profitability index by dividing the net present value of the project by the investment required. I highly encourage you to do this when you are looking at several investments at once. In our example above, the Profitability Index is $5.96. That means for every $1 we invest, we are making $5.96.

Again, just go to this Google Sheet and it will do all the math for you. Click File – Make a Copy to create a version you can edit. The general rule is that if the profitability index is greater than 0 it’s good (meaning net present value is positive). If PI < 0 it’s bad (net present value is negative). If PI = 0 then the net present value of the investment = $0. If you are comparing several investments, you can determine which one will create the biggest return for each dollar that you invest today.

How can I get help deciding which party rental equipment inventory to add to my business?

If you are a Revental’s vendor, you can always schedule time with me (just email info@reventals.com), and I’ll be happy to help you with these evaluations. And if you aren’t a Revental’s vendor, contact us about becoming one!

Contact Us For Help Planning Your Event